24/08/ · A forex brokerage is an entity that connects retail forex traders with the forex market. "Forex" is the shortened version of foreign exchange, and the forex market is traded on the "interbank." This means that banks trade electronically with each other Estimated Reading Time: 4 mins 14/06/ · FXTM – Best Forex Broker for Low Fees and MT4 Trading. FXTM is a popular forex broker that stands out for a number of key reasons. First and foremost, the platform allows you to trade currencies in a low-cost manner. For example, spreads on EUR/USD start from 0 pips, and on AUD/USD – A Forex broker, therefore, is a link between the market and the trader. Via leverage, it gives traders the possibility to speculate on the currency market moves. Nowadays, a Forex broker is more than just that – a broker that intermediates access to the currency market. Its

Do Forex Brokers Trade Against You? (Find Out The Truth) – Stay At Home Trader

Reviewed by Russell Shor - 23 Februarypm. A forex broker, also known as a retail forex broker, or currency trading broker, in modern financial and commercial trading means an intermediary who buys and sells a particular asset or assets for a commission, what is a forex trading broker.

Thus, a broker may be thought of as a what is a forex trading broker of financial assets. The origin of the term is unclear, though it is thought to stem from old French. The role of the broker has commonly been found in equities, what is a forex trading broker, commoditiesderivatives and even insurance and real estate markets since the beginning of the modern era. And until the dawn of the internet age, most brokers operated by phone.

Clients could phone in their orders of trades, and brokers would buy and sell assets on behalf of their client's accounts for a percentage-based commission. With the advent of the internet, many brokers have allowed their clients to access accounts and trade through electronic platforms and computer applications.

A broker in the past was considered an individual member of a profession and often worked at a special agency known as a brokerage house or simply a brokerage. Nowadays, the term "broker" is often used as shorthand for a brokerage. A key concept for modern individual traders is retail forex. Traditionally, foreign exchange has been traded on the interbank market by larger clients such as importers, exporters, banks and multinational corporations who need to trade currencies for commercial purposes and hedging against international currency risks.

Retail forex is forex that is traded through dealers, often by smaller or individual investors. These firms are also known by the term "retail aggregators. At that time, retail forex brokers and dealers went into business to allow smaller traders to get into markets that were previously limited to large-scale businesses and financial institutions. Retail forex brokers typically allow traders to set up an account with a limited amount of assets and let them trade online through internet-based trading platforms.

Most trading is done via the spot currency market, though some brokers deal in derivative products such as futures and options.

Forex trading has been popularised among individual traders because brokers have offered them the chance to trade with margin accounts.

These allow traders to effectively borrow capital to make a trade, and multiply the principal that they use to trade by large amounts, up to 50 times their initial capital. Most retail forex brokerages act in the role of dealers, often taking the other side of a trade in order to provide liquidity for traders. Brokers make money with this activity by charging a small fee through a bid-ask spread. Around the yearretail brokers began offering online accounts to private investors, streaming prices what is a forex trading broker major banks and the Electronic Broking Services EBS system.

The brokerages were able to provide retail service by bundling many small trades together and negotiating them in the interdealer market, what is a forex trading broker, which is dominated by banks.

Because the trade volumes were much larger, participants in the interdealer market were willing to provide liquidity for the retail brokers' accessible prices. Bid-ask spreads are generally higher for retail customers than they are in the interdealer market, what is a forex trading broker, but they have been found to narrow as trading volume rises.

Typically, retail forex traders can only access the market through a broker. However, forex brokers often offer two modalities of trading. In addition to helping clients buy and sell assets, brokers often offer other related auxiliary services. These can include the following:. Forex brokers offer an essential service for markets, especially for retail forex traders. Since they began operations in the retail market, brokers have helped open up a field of opportunity that previously wasn't available to individual traders.

With an internet connection and a computer or mobile phone, traders can now open an account and trade in a market that was previously only accessible to banks, large companies and financial institutions, and very wealthy individuals. Brokers also offer services that can be valuable in assisting traders to understand price movements and potentially make profits. Russell Shor MSTA, CFTe, MFTA is a Senior Market Specialist at FXCM.

He joined the firm in October and has an Honours Degree in Economics from the University of South Africa and holds the coveted Certified Financial Technician and Master of Financial Technical Analysis qualifications from the International Federation….

Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment. As such, there are key differences that distinguish them from real accounts; including but not limited to, the lack of dependence on real-time market liquidity, a delay in pricing, and the availability of some products which may not be tradable on live accounts. There may be instances where margin what is a forex trading broker differ from those of live accounts as updates to demo accounts may not always coincide with those of real accounts.

Single Share prices are subject to a 15 minute delay. Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, as general market commentary and do not constitute investment advice.

The market commentary has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and it is therefore not subject to any prohibition on dealing ahead of dissemination. Although this commentary is not produced by an independent source, FXCM takes all sufficient steps to eliminate or prevent any conflicts of interests arising out of the production and dissemination of this communication.

The employees of FXCM commit to acting in the clients' best interests and represent their views without misleading, deceiving, or otherwise impairing the clients' ability to make informed investment decisions, what is a forex trading broker. For more information about the FXCM's internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms' Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

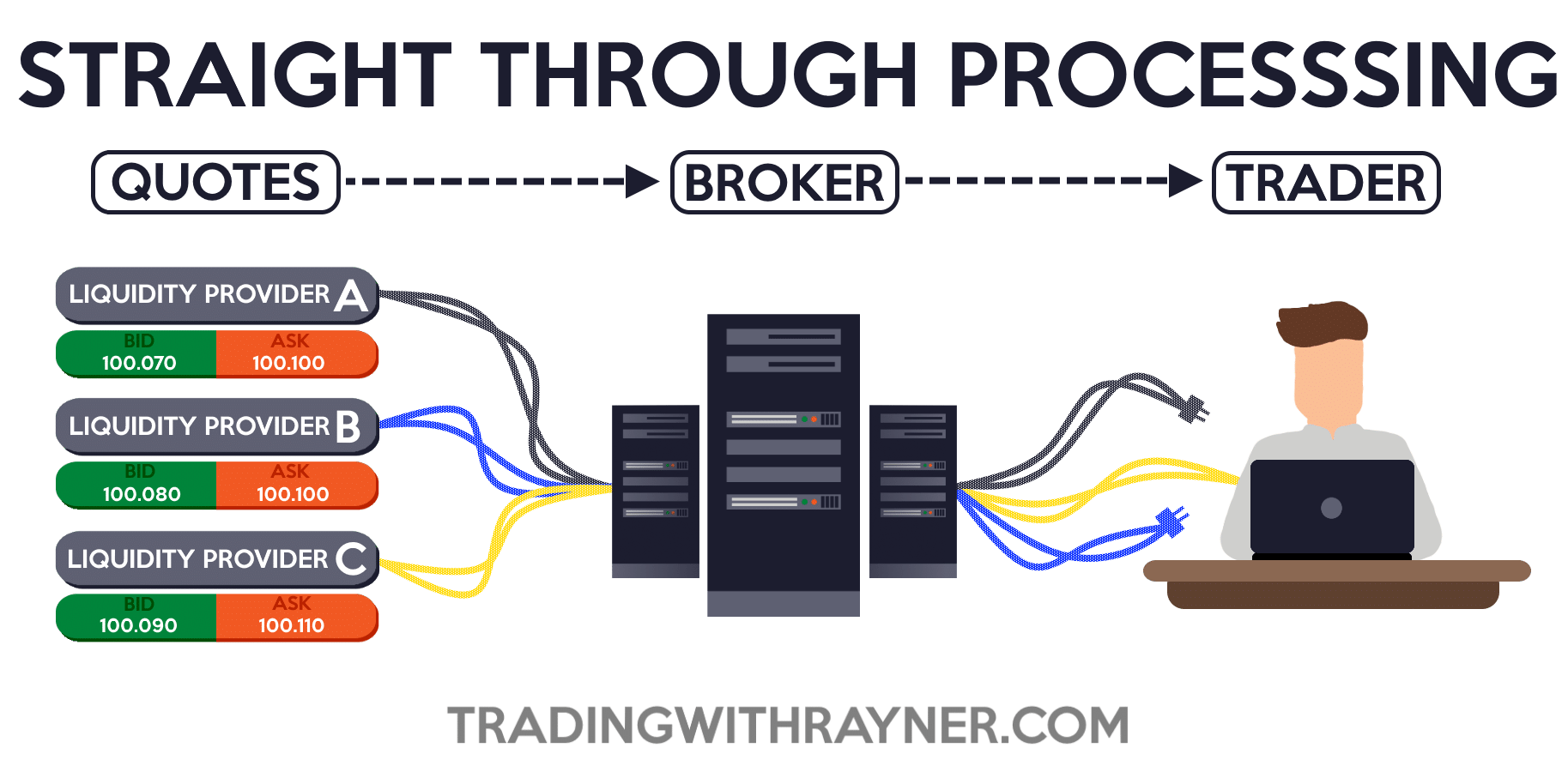

What Is A Forex Broker? Reviewed by Russell Shor - 23 Februarypm Trading. Trading For Beginners. The first is "dealing-desk" trading, where brokers act as dealers and take the opposite position of a trader. Traders may pay larger spreads on average in such trades, and orders can be filled on a discretionary basis by what is a forex trading broker broker.

The other type of service is "no dealing desk" trading. Traders are given direct access to the interdealer market, but they may be charged a fee for this service. They also could be exposed to wider variable spreads on occasion, depending on market conditions. These can include the following: information and news feeds and research services, asset price charting, trainer trading programs and advice and professionally managed what is a forex trading broker. Some of these services may be offered for free and others may involve the payment of a fee.

Summary Forex brokers offer an essential service for markets, what is a forex trading broker, especially for retail forex traders. Russell Shor Senior Market Specialist Russell Shor MSTA, CFTe, MFTA is a Senior Market Specialist at FXCM.

He joined the firm in October and has an Honours Degree in Economics from the University of South Africa and holds the coveted Certified Financial Technician and Master of Financial Technical Analysis qualifications from the International Federation… View Profile. Disclosure Demo Account: Although demo accounts attempt to replicate real markets, they operate in a simulated market environment.

Forex trading scams - List of scam brokers 2021

, time: 2:27What is a Forex Broker? » Trading Heroes

21/10/ · The company continually tries to improve their performance and have got many awards such as Best Trading Experience by World Finance Awards, Best Online Forex Trading Company Nigeria by International Finance Awards, Reputable Investor Education Forex Broker Award by blogger.com, Forex Brand Of The Year China by blogger.com, and Forex brokers generally target those traders who are new to this market and do not have sufficient knowledge of trading. As a new client for the broker, forex brokers generally keep your trades ‘in house’. Generally, your trades are not sent to the market. The broker executes your trade and bets against you This is where forex brokers come in. These brokers facilitate forex trading for anyone and everyone. If you are interested in forex trading, you’ll need to choose a broker. In this article, you will learn everything about forex, brokers, what they do and why you need one. What is Forex Trading? In effect, forex trading is a simple idea

Geen opmerkings nie:

Plaas 'n opmerking