QuantForexTrading currently offers automated trading through Oanda broker. All strategies have been backtested using historical data and configured for lower risk setting. The following is the backtested results trading all pairs grouped by different currencies. The strategy is based on a Forex Quant Strategy. The Quant trading system is known to capitalize on statistics, numerical analysis and computer algorithm to considerably shrink the amount of time and energy traders require to put in for researching and blogger.comted Reading Time: 4 mins 11/05/ · Quantitative investment strategies, or quant strategies, are designed to exploit inefficiencies and use leverage to make market bets

Using Quantitative Investment Strategies

Classic trading uses fundamental and technical analysis. Quantitative trading strategies are a radically different approach that has much in common with algorithmic trading and neural networks, some of them have direct correlation to high-frequency trading.

Quant trading strategies rely on mathematical modeling using software algorithms and statistical methods. using computer programming software such as EViews or MATLAB. Are they accessible for private traders? This is a rhetorical question. But you need to know about their existence if only because quant based trading strategies are used by market makers hedge funds or investment banks.

Which strategies are more profitable: ones based on technical or fundamental analysis? Manual strategies or ones that use trading advisors? The example of the world's leading investment funds shows that neither fundamental nor technical analysis meets expectations. However, there is another trading method - quantitative strategies.

In this review, I will try to outline the essence of this method and show the main differences from the usual trading strategies based on fundamental and technical indicators.

Quantitative trading is built on mathematical methods and statistical analysis using programming. Therefore, the purpose of this review is to only inform of the existence of such a method, quantitative forex trading strategies. It does not matter what tools, strategies or type of analysis are used for this, as long as it does the trick. You only need to find reversal points, determine the strength of the trend and enter the market at its quantitative forex trading strategies. In fundamental analysis, the trader tries to predict the direction of movement after the news or based on wave-like movement of the global economy.

The strategy is based on the fact that the market will somehow respond to information, stimulating the growth of demand or supply. In technical analysis, fundamental factors are excluded. The trader analyzes the history and finds patterns. Force majeure and other fundamental factors are automatically taken into account in the general trend. But there is another trading method that does not involve either technical or fundamental analysis. For it, quantitative forex trading strategies, predicting the direction of the trend is a secondary issue, and the releases of the Central Banks are irrelevant.

Currency quotes here are just a set of basic input market data on which the network machine algorithm is built. This method is called quantitative trading strategy or quant based trading strategy. The point of quants trading strategies is not to predict the direction of the trend, but to find the optimal strategy and the best set of trading tools by selecting a mathematical set of parameters that will ultimately allow you to get a stable profit.

Despite seeming somewhat pointless, algorithmic trading and quantitative strategies have been known for more than half a century and actively used by investment hedge funds. One of the first companies to apply quant based trading strategies was the George Soros Foundation. Soros was able to prove in practice that fundamental and technical analysis are inferior in comparison with the strength of capital.

This is why his fund was one of the first to give up assessing the monetary policy of the Central Bank and searching for technical patterns in favor of mathematical modeling and programming.

InFischer Black and Myron Scholes first published the option pricing model formula. The key point in determining the value of the option was the expected volatility of the underlying asset, the level of which can be calculated mathematically. Without going into details, the formula includes the cumulative distribution function of the standard normal distribution, the risk-free interest rate we see something similar in the Sharpe ratiospot and strike prices, and volatility. To characterize quantitative forex trading strategies sensitivity of the option price to changes in certain values, coefficients called greeks based on the letters of the Greek alphabet are used.

Inthe Black-Scholes model won the Nobel Prize in economics, radically changing the approach to developing trading strategies. Today's real examples of using quantitative trading models are:. Two Sigma Investments - the fund was founded quantitative forex trading strategies Its trading strategies are based on methods using artificial intelligence, machine learning an analogue of neural networksand distributed computing. The company is known for its development of sophisticated modeling systems and programs that track market anomalies.

Renaissance Quantitative forex trading strategies LLC - the company was founded in It specializes in trading in quantitative models developed on the basis of mathematical and statistical analysis. Quantitative trading is based on the principle "the more the better".

The data obtained are quantitative forex trading strategies as follows:, quantitative forex trading strategies. As a function. The job of the programmer writing the model code is to find this very function to build an equation that would describe the distribution of quotes in a time series.

As a time series that is analyzed by statistical methods. The accuracy of forecasting by statistical regularity is tested on other time intervals forward testing. The quantitative trader can get some extreme points from the function and time series that describe the price movement chart. By adding an additional mathematical apparatus approximation, entropyyou can calculate the areas of trend slowdown, flat, or calculate the predicted stop order points. And only later a quantitative trader may try the strategy in real time, applying the risk management required.

Another method of econometric analysis on which quantitative trading strategy is based is to break the time section into separate clusters areas where you can see a clear price movement according to a certain pattern. For example, a section 10 years long, is divided into segments of different lengths 1 day, 1 week - they do not have to be the sameon which the pattern is visible.

Moreover, the sections can intersect and overlap each other - a neural network with algorithmic program code finds all these sets of patterns. The current market conditions are compared with similar patterns of price behavior in the past, based on which a further forecast is quantitative forex trading strategies. High liquidity.

Only highly liquid instruments are selected for quantitative trading strategies, quantitative forex trading strategies, quantitative forex trading strategies this method is more common on stock markets than on Forex.

Quant trading strategies involves launching mathematical algorithms for a large number of instruments. It will not work on one currency pair.

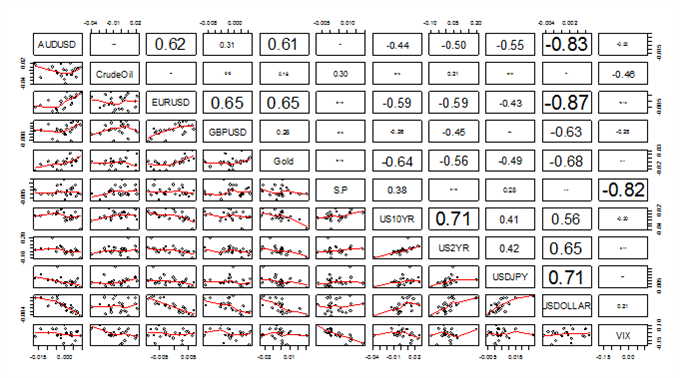

In this case, the correlation coefficient between instruments should be as low as possible. Quantitative analysis works for the largest possible number of algorithms three variants of such algorithms - function search, distribution of number series and template trading - are described above.

The model of quantitative strategies has something in common with the algorithmic advisor trading. The formula of moving averages attempts to search for patterns of price movement. And over time, technical analysis enthusiasts added a series of coefficients to the formula, which became EMA, LMA, etc. Still, forex quantitative trading is not the Grail, but just another trading method. There are companies involved in the development of such algorithms and selling the product to individual traders.

Quant trading strategies are another attempt to get closer to the Grail using the methods of mathematical and statistical analysis and programming. There are a lot of quant traders convinced that this model works in financial markets much better than technical and fundamental analysis.

But I did not find open information about the profitability of such strategies. Quant based trading strategies should only be used for stock market instruments.

Therefore, quantitative trading strategies are used either for trading securities stocks of corporationsor stock indices, quantitative forex trading strategies. If you have experience in using quant trading strategies, be sure to share it in the comments! The point of quantitative trading is to find the optimal strategy and the best set of trading tools by selecting a mathematical set of parameters, which ultimately will allow you to get a stable profit.

Did you like my article? Ask me questions and comment below, quantitative forex trading strategies.

Home Blog Professionals Quantitative Trading. Quantitative Trading FAQs What is quant trading? Rate this article:. Need to ask the author a question? Please, quantitative forex trading strategies, quantitative forex trading strategies the Comments section below. Start Quantitative forex trading strategies Cannot read us every day? Get the most popular posts to your email.

Full name, quantitative forex trading strategies. Written by. Oleg Tkachenko Economic observer. NeoWave theory by Glenn Neely. An introduction to missing waves and emulation. Trading strategy based on the NeoWave theory.

Follow us in social networks! Facebook Twitter Instagram LinkedIn Youtube Telegram RSS Feed MQL5.

$1000 to $408,946 - A Full Time PRO Algorithmic Forex Trading Journey (Episode 1)

, time: 6:47Exploring Quantitative Trading Strategies - Forex Training Group

11/06/ · Mandatory conditions for using the quantitative trading strategy: High liquidity. Only highly liquid instruments are selected for quantitative trading strategies, therefore this method is more common on stock markets than on Forex. Diversification. Quant trading strategies involves launching mathematical algorithms for a large number of Estimated Reading Time: 10 mins 10/05/ · Benefit from the quantitative trading strategies with Mathew Verdouw and listen to the podcast by clicking on the link. Forex trading involves risk. Losses can exceed blogger.comted Reading Time: 4 mins QuantForexTrading currently offers automated trading through Oanda broker. All strategies have been backtested using historical data and configured for lower risk setting. The following is the backtested results trading all pairs grouped by different currencies. The strategy is based on a

Geen opmerkings nie:

Plaas 'n opmerking