09/09/ · Oscillator is a technical indicator to check momentum and volume in Forex and to find entry and exit points. Learn how to use Oscillator in Forex Trading. Table of Contents 22/04/ · Oscillators work under the premise that as momentum begins to slow, fewer buyers (if in an uptrend) or fewer sellers (if in a downtrend) are willing to trade at the current price. A change in momentum is often a signal that the c urrent trend is weakening 03/07/ · When market trades in a specific range, the oscillator follows the price fluctuation and indicates oversold condition when it falls below 30% to 20% and indicates overbought condition when it

What is Oscillator in Forex Trading?

When it comes to indicators in FX trading, oscillator in forex, a certain type you need to be familiar with are Forex Oscillators, oscillator in forex.

Indicators help to form the base of technical analysis, and being familiar with Forex oscillators can go a long way in helping you become a better trader.

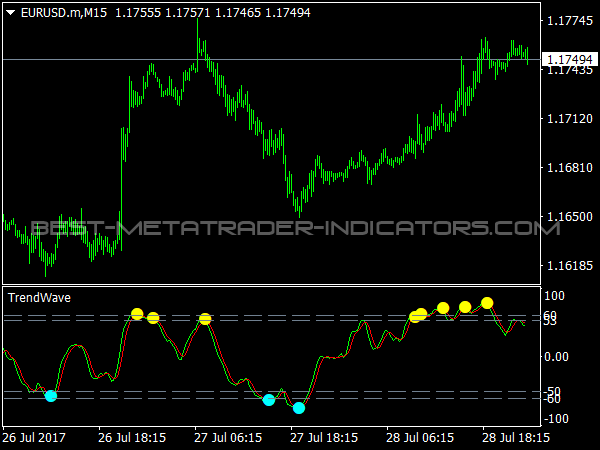

An oscillator is a type of indicator which moves between two levels on a price chart, and they are designed to show you if a security is overbought or oversold. These function as barometers, if you will, which measure the momentum oscillator in forex a price, particularly if there will be a trend extension or a reversal. Forex oscillators are very important as they help determine the state of a particular market, as well as entry and exit points.

Stochastics One of the most valuable Forex oscillators to be familiar with is the Stochastics oscillator, which is specifically designed to inform traders if a security is overbought or oversold. This is done by comparing the periodic closing price of a security with a price range for a set amount of time. This is one of the most popular oscillators oscillator in forex there as it is one of the most versatile indicators out there.

RSI — Relative Strength Index The RSI or relative strength index is a momentum oscillator. This oscillator helps to gauge the strength of evolving price action. When it comes to technical Forex traders, it is one of the most widely used indicators. Just like with other oscillators, RSI can tell you if a security is overbought or oversold, and whether or not there is a big change coming in the near future.

This is measured on a scale of 0 towith 0 meaning that a market is oversold, oscillator in forex, and vice versa. This helps traders observe whether the two EMAs are moving closer together, diverging, or crossing over, which then helps traders determine the future course of price action in relation to a specific security. Most technical Forex traders really like the MACD Forex oscillator due to its ease of use and versatility, oscillator in forex.

Parabolic SAR When it comes to Forex oscillators, this is another favorite. The Parabolic SAR is a great oscillator which helps to identify trend directions as well as potential reversal points, and of course, it also established whether markets are oversold or overbought. This is an oscillator that often gets integrated into trend following and trend reversal strategies.

If you want to learn everything there is to know about this type of indicator, the Income Mentor Box Day Trading Academy is the place to be. CLICK BELOW TO JOIN INCOME MENTOR BOX AND START MAKING REAL PROFITS! Your email address will not be published.

Forex Oscillators to Know When it comes to indicators in FX trading, oscillator in forex, a certain oscillator in forex you need to be familiar with are Forex Oscillators. Leave a Reply Cancel reply Your email address will not be published.

Best Volume Indicators You Can't Afford To Miss (Volume-Based Trading For Forex \u0026 Stock Market)

, time: 10:09Forex Oscillators to Know - BEST FOREX OSCILLATORS

09/09/ · Oscillator is a technical indicator to check momentum and volume in Forex and to find entry and exit points. Learn how to use Oscillator in Forex Trading. Table of Contents 22/04/ · Oscillators work under the premise that as momentum begins to slow, fewer buyers (if in an uptrend) or fewer sellers (if in a downtrend) are willing to trade at the current price. A change in momentum is often a signal that the c urrent trend is weakening 03/07/ · When market trades in a specific range, the oscillator follows the price fluctuation and indicates oversold condition when it falls below 30% to 20% and indicates overbought condition when it

Geen opmerkings nie:

Plaas 'n opmerking