21/11/ · Trade Entry Triggers. So, let’s say you got notified by the alert that the price reached your pre-planned level. It’s now time for you to make a decision based on your set of rules. If you don’t have rules, you should not trade a live account yet. One of my entry rules is that I want to see at least one Candlestick Pattern inside my kill blogger.comted Reading Time: 6 mins 23/10/ · Using breakouts as entry signals is one of the most utilised trade entry tools by traders. Breakout trading involves identifying key levels and using these as markers to enter blogger.comted Reading Time: 4 mins 28/03/ · The first step to finding an entry signal involves scanning your charts. You need to decide the best Forex pairs to trade and then scan the daily charts first; you should do this around the same time each day. The best time to analyze your daily charts is

Find Your Forex Entry Point: 3 Entry Strategies To Try

Almost every trader asks, what is the best trade entry? Since you are here reading this article, I suppose that you are asking that question too right now and wanting to know the answer.

I am just kidding. A good entry will give you a much how to enter a trade in forex Risk to Reward Ratio RR. Many new traders make the mistake of chasing the price, entering a trade based on a sudden market movement. How many times did you find yourself in a trade based on an immediate breakout along with a large candle? Well, I can remember a few of those entries my self, how to enter a trade in forex. I use to be sitting in front of my desktop, watching the market, suddenly a break out happens, and as fast as a space rocket, my fingers hit the how to enter a trade in forex, and I click the buy button.

Seeing that candle moving in my direction makes me feel like the king of the market. The moment deserves a beer, and sure it does, look at that profit at the bottom right corner of my trading platform. After a first glance at the chart, What I see is that the big lovely green candle is now a substantial red candle with a wick taller than a giraffe neck.

Paralyzed of the situation, I am sitting there, praying for the gods to make the market reverse back. It seems like they are busy saving some other traders, not having time for me at the moment.

So at this point, the damage is significant. The pain is enormous, time to close the trade. I hit that button, and there we go, another loss added to the list. Man, looking back at that trade, I could have the best price ever if I took the opposite side of it. We are so damn good at gathering coupons, credit card points, joining consumer clubs, how to enter a trade in forex, and so on. We wait for Black Friday or Cyber Monday the whole year to buy a smart TV.

You open your trading platform with one thing in how to enter a trade in forex mind, how to enter a trade in forex, and that is to get involved in trades.

We, humans, love to create stuff, do things, and feel that we are in charge. So being involved in the market makes you think that you are doing what you supposed to do, trading! The answer to that question is yes, a trader does get involved in trades, and being in the market is a big part of the game.

But trading is so much more than entering trades. Then more waiting for the trigger signal, to then maybe enter a trade, depends if their rules got met or not. That is how a smart shopper would act in the market. So why not approach the market the same way as your day to day shopping? All you have to do is, wait for the price to come to you. There are many kinds of trade entries and strategies.

I will cover the most common ones here. They have to be so, that way I can make my point and give you as many good examples as possible. A whole session is dedicated to planning trades entry, stop-loss, how to enter a trade in forex, and target placement. While here in this article, I will cover the most basic entry strategies. Last week, the market was waiting and expecting a rate cut on NZDUSD. The RBNZ shocked the market with no cut, and NZDUSD shoots up like a rocket. At the time, you would think this market will keep moving up forever.

Never, so why chase it? Let the move happen and look at how you can get involved later when the dust settles, and the price is back at value. The price will always move back to fair value. The smart money will never buy at that high level, and the price will start pulling back to find buyers again. No matter what market you trading, that is always the case. So, forget the buy and sell buttons for now.

Go ahead, start planning It, and drawing where you expect the market to pull back to. So, how to enter a trade in forex, let take you to the next level, planning a trade like a professional trader. As mentioned above, the move happened due to the RBNZ surprising the market with no cut.

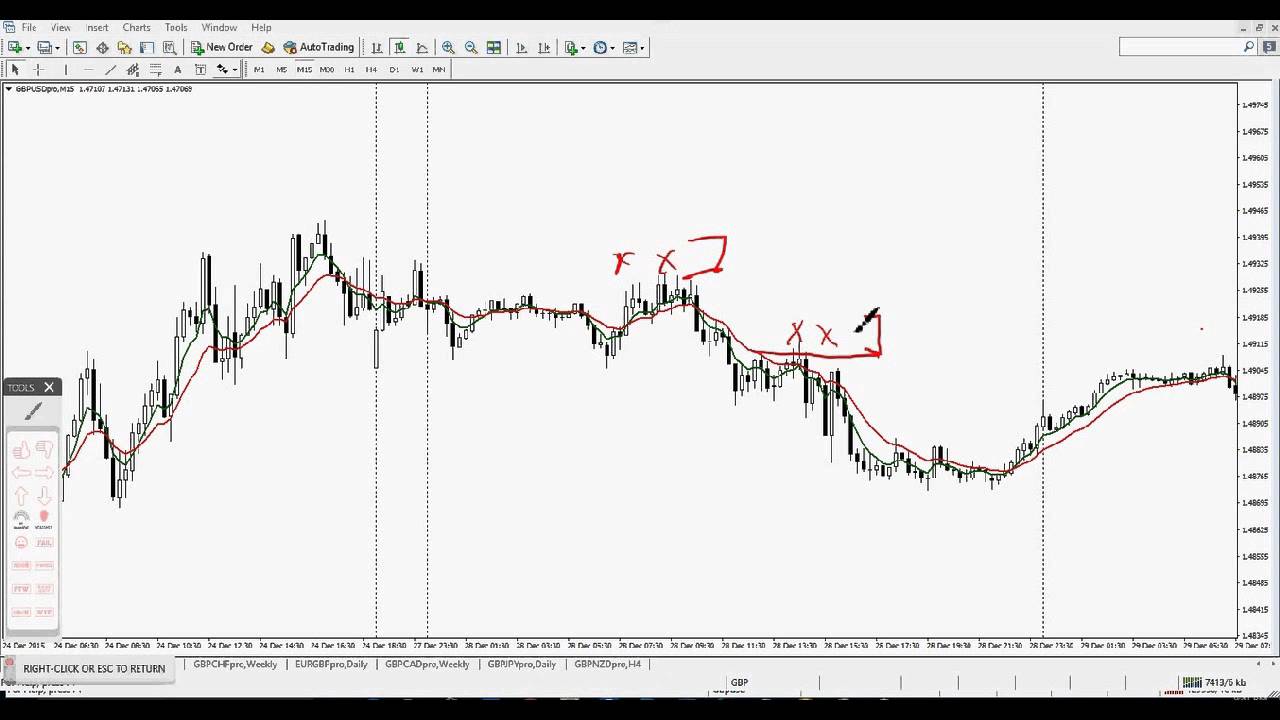

So, what about the how? The first thing I do in such a scenario is to look for the most significant swing high In this case. Looking left, you can see a clear swing high where we can see the Head and Shoulders Pattern at point A.

As you may see, I also drew how to enter a trade in forex Fibonacci Retracement Fibadding some confluence to the idea. There are even more confluences that we can use to be more confident in the trade. For this article, we will only use the Fibonacci retracement tool. So, the previously broken significant swing high is now marked as well as the Fibonacci retracement. In this area, we want to see our trigger happening. Depends on your trading strategy, it could be that you are waiting for a pin bar, bullish engulfing candle, or chart pattern to happen in the Kill Zone to confirm that bulls are ready to start a push higher from this area.

Watch this video series, to learn more about Candlestick And Chart Patterns. So, what now? Do you sit there, waiting for the market to move to your level of interest? No, now, you add that chart to your watchlist. What I also do is putting an alert just above the kill zone to get notified when the price reaches my levels of interest.

That way, I do not need to keep checking the charts. That way, I will not make impulsive decisions either. One of my entry rules is that I want to see at least one Candlestick Pattern inside my kill zone. Another rule for the conservative trader could be a confirmation candle, in this case, the candle that closed above the Morning Star candle.

At this point, no need for more analysis. Another way for entring such a trade would be by using a buy limit order in or at the top of the kill zone. Using limit orders have a higher failure risk, and you could miss out on some trades. For the more aggressive trader, it works just fine. Now, is the time to plan the exit for both target and SL placement.

For that, there are also many strategies, and I teach many of them for different trade scenarios. For the entry, you enter on the next candle open. Stop-loss, in this case, has to be set below the low of the morning star candle Also known as Pin Bar or Hammer.

Give the stop-loss some buffer below the wick, do not put it too close. Even here every trader should have a set of rules, how many pips below the previous low should the stop-loss be. The easiest way is to use the ATR indicator, Investopedia ATR Definition my recommendation is to have at least 1 ATR below the low of the candle. For targets, two take profit levels, with the first target at least a risk to reward, or at first significant swing high looking left at the previous structure.

Target two is set at the highest top of the whole swing. Now, if you want to ride the possible new bullish trend, what you could do is to trail your stop-loss below the higher swing lows that happen on the way up. Well, the same as explained above should be repeated.

Let it run and back to the drawing table to try and find the next possible entry-level. As you see in the chart below, the market did not reach the target at the first leg up. It did a pullback almost back to the entry, to then start moving up again and reached the primary objective. Even at this point, the market was kind enough to give you yet another pullback. A new chance to enter once a long trade.

The last significant drop before the strong bullish move gave a strong signal for a long trade, after printing a bullish engulfing candle Reversal Candlestick Pattern. What did how to enter a trade in forex learn from this so far? Yes, you will have trades that will go against you.

No matter what you do and how good a trader you are. As you see below, the same analysis and preparations as above. The trend was a beautiful, strong bearish trend. We drew our level of interest the same as before, at the broken swing low. We had the Fibonacci retracement as a confluence area. Still, the market made a move up instead and stopped the trade. All you can do is, following your trading plan and rules.

Being disciplined is the most significant one thing that will help you to stay in this game as long as possible. This trade below is a good trade that went bad. Persistence is another crucial component both in trading and many things in life. So, you had a losing trade, but you followed the plan and the rules. As soon as you get another how to enter a trade in forex, you should go for it.

Basically, if we continue looking at the same chart and even though you had a losing trade.

HOW TO ENTER AND EXIT TRADES IN FOREX!! (STEP BY STEP)

, time: 24:07The smart way to enter a Forex trade - Set your own price traps

21/11/ · Trade Entry Triggers. So, let’s say you got notified by the alert that the price reached your pre-planned level. It’s now time for you to make a decision based on your set of rules. If you don’t have rules, you should not trade a live account yet. One of my entry rules is that I want to see at least one Candlestick Pattern inside my kill blogger.comted Reading Time: 6 mins 12/10/ · How to Enter a Forex Trade. An entry point refers to the exact price at which a Forex trader opens a buy or sell position. Metaphorically speaking, it is when you open fire and go into the market. Proper entry points are defined after thorough market research and are typically part of a planned trading strategy for reducing investment risk. They can maximize your profits in each trade, 28/03/ · The first step to finding an entry signal involves scanning your charts. You need to decide the best Forex pairs to trade and then scan the daily charts first; you should do this around the same time each day. The best time to analyze your daily charts is

Geen opmerkings nie:

Plaas 'n opmerking