/Foreign-currencies-58c5b0253df78c353c57c52f.jpg)

14/07/ · The most volatile forex pairs (forex pairs that move the most) in the last several years are exotic pairs (SEK, HUF, TRK) and GBP cross pairs such as GBPNZD GBPCAD. The least volatile currency pairs are EURCHF, EURUSD, AUDCHF, USDCHF, EURCAD, etc. But Estimated Reading Time: 8 mins 03/05/ · The pip value is a unit of measurement for currency movement in most currency pairs in the forex trade. The pip between two currencies varies. However, it is generally equal to the fourth decimal place in most currency pairs. For EURUSD or GBPUSD, for example, is one blogger.comted Reading Time: 7 mins What forex pair has the highest pip value? - Quora

How to Calculate a Pip Value? - Forex Education

Which Forex pairs are the most volatile? Which Forex pairs should you be looking for right now? I said, looking at it because I am NOT saying you should trade. These particular pairs are riskier than the main currency pairsbut you should really look at these pairs. The most volatile currency pairs can actually offer more lucrative trading opportunities for forex traders. Did you know the most volatile Forex pairs can move on average for more than points per day?

If you are looking for Forex pairs that move, you probably have experienced it where you place a trade, and you have to wait a very long time before you start seeing any meaningful movement or meaningful profit with them. Sometimes they do not do anything. Sometimes they are just waiting, forex pairs with most pip values, but when they take off they really take off.

So if you are looking to make those fast pips those quick profits, forex pairs with most pip values, you need to find the perfect timing to enter your trades.

Looking for movement, you should be looking at the GBP pairs. My experience is that this is where the best action is in the entire forex market. I promise you the GBP pairs, they gonna move. Then we have the exotic currency pairs. Most people seem to focus on the main currency pairs for their forex trading. If you are looking for movement, if you are looking for Forex pairs to squeeze, then I think you should also look at the exotics. They move when these things decide to move. They simply take off.

The most volatile forex pairs with most pip values pairs offer enticing prospects for profit because their price movements can be more dramatic than less volatile pairs. Exotic currency pairs are considered more volatile because of limited liquidity, along with unstable economic conditions in emerging economies. So exotic currency pairs have, forex pairs with most pip values, on average, much higher price fluctuations compared with cross pairs or majors.

Currency pairs differ in terms of volatility levels and you can decide to trade high volatile pairs or pairs with lower volatility. The volatility of a currency pair shows price movements during a specific period. Volatility is actually explained very well on currency. Smaller price movements will indicate lower volatility whereas higher or frequent movements mean higher volatility, forex pairs with most pip values. The price movement of the currency pair is commonly considered in terms of pips, so a currency pair moving pips on average during a given period will be more forex pairs with most pip values than a pair moving 50 pips in the same period.

The volatility level is affected by major economic data releases and political events, as well as liquidity or simply supply and demand for the pair. Volatility is a term used to refer to the fluctuations in price over time. The more price fluctuates, the higher the volatility is considered to be. With the tool below, you will be able to determine which pairs are the most volatile. You can also see which are the most and least volatile hours of the week, days, forex pairs with most pip values months for specific pairs.

Source: Babypips, forex pairs with most pip values. Remember that the volatility of a currency pair can change over time as the relevant factors change. But overall, the pairs below are considered some of the most volatile and least volatile. So we are quickly going to go onto the charts and see what you can expect when these Forex pairs decide to move.

They can give you hundreds over a hundred fifty over two hundred pips with just a few candles. For example, here we got Pips with just 9 bars. It goes that quick when it decides, and this happened on the 30th of September.

Trading volume is increased around midnight on the U. East Coast, continuing through the night and into the American lunch hour when forex trading activity can drop significantly. This time with The British Pound vs. Swiss Franc cross, one of the most volatile forex pairs.

Look at these 4 bars. You get pips. This is going super fast when it already has decided. In turn, the CHF is used as a reserve currency around the world and is currently ranked rarely 5th or 6th in value held as reserves after the United States dollar, the euro, the Japanese yen, the pound sterling, and the Canadian dollar. Taking off better, be ready, GBPJPY, many traders love this one. GBPJPY cough candles paid in candles. You get pips, All you need to do is to get in, get out.

Notice there are only 6 bars and 3 hours to fulfill this amazing trade that happened on the 1st of October. The GBPJPY currency cross is one of the most volatile currency pairs out there, according to The Balanceand false signals are not uncommon. There are even Geppy blogs fully dedicated to telling tales of its moves. Well, you will make you target The British Pound vs. the Australian Dollar. Get ready for a real take-off!

Due to its relatively higher interest rates and its correlation to global equity markets, the GBPAUD is often referred to as a risk currency pair. If you are looking for one of the most frequently traded currency pairs in the world, then you should pay attention to the AUDUSD Australian Dollar — US Dollar according to DailyFX. The AUDUSD rate, as shown in the real-time price chart, tells traders how many US Dollars are needed to buy a single Australian Dollar. AUDJPY is another volatile pair, forex pairs with most pip values if you can catch the trend at the right time, you can easily make money.

It took 8 hours to make Pips with AUDJPY on the 21st of September. All it required was 8 bars! CADJPY offered us a double opportunity to make some quick Pips!

First, it went forex pairs with most pip values, and you could make Pips on 14 bars. Then it went bullish and you could make 92 Pips on 10 bars.

When a trader is unsure about trading the US Dollar, The Canadian Dollar vs. the Japanese Yen is often determined to be a suitable replacement, according to TradingView. However, the historically higher yield of the Canadian dollar in the past has made the CADJPY more sensitive to market-wide sentiment changes than the USDJPY.

But the next example is amazing. We talk about only 10 bars! This is a good example of another volatile currency pair. If you are looking for Forex pairs with good return, USDNOK can be a profitable investment option, according to WalletInvestor.

USDNOK is the financial symbol that refers to the spot exchange rate of the US dollar and the Norwegian Krone. It has been managed by its central bank called the Norges Bank. Just like any currency, the USDNOK rate tends to be sensitive to central bank announcements as well as to economic data. Norway is known to have one of the most stable economies in Europe. Source: Investingcube. Have a look at USDZAR on the 1h chart. Between 10 am and 5 pm we were able to catch Pips, and it only required 8 bars!

Volatility in this pair is greatly affected by the price of gold. As a result, if the price of gold is rising, the price of the dollar will likely also increase against ZAR. This is good for South African exporters because it means that they will get more US dollars for their gold on the world markets.

Source: IG. The 9th most traded currency pair on the international forex market, USD to MXN provides a high level of liquidity. As neighboring nations with a large shared border, Mexico and the USA enjoy close trade and economic relations. This has been underpinned by the signing of the North America Free Trade Agreement inwhich saw all tariffs between the two nations eliminated. The high-yielding nature of the Mexican Peso makes it one of the ideal carry trading currencies.

Source: Oanda. Volatile currency pairs can offer many opportunities for profit, and my suggestion is probably to go for those pairs above, but there are many other pairs that you can say.

I hope this helps you. I have been trading for 10 years and have joined several top-class Forex courses and been coached by some of the leading mentors in the Forex pairs with most pip values world, forex pairs with most pip values.

Now it's time to share my knowledge and experience with other Forex traders out there. This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful. Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

New posts Home. Expert's Corner. The most volatile currency pairs may give you higher price fluctuations — and greater forex pairs with most pip values to make fast pips!

What are the best currency pairs for forex day trading?

, time: 3:48Spread-to-Pip Potential: Which Are Worth Day Trading?

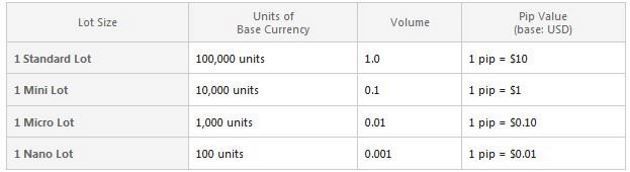

03/05/ · The pip value is a unit of measurement for currency movement in most currency pairs in the forex trade. The pip between two currencies varies. However, it is generally equal to the fourth decimal place in most currency pairs. For EURUSD or GBPUSD, for example, is one blogger.comted Reading Time: 7 mins 01/06/ · Divide the pip values above by the USD/XXX rate. For example, to get the pip value of a standard lot for the U.S. dollar/Canadian dollar (USD/CAD) when trading in a USD account, divide USD$10 by the USD/CAD rate. If the USD/CAD rate is , the standard lot pip value is USD$, or USD$10 divided by Estimated Reading Time: 5 mins 72 rows · pair pip value (usd) pip value (eur) pip value (gbp) audcad: audchf

Geen opmerkings nie:

Plaas 'n opmerking