Our Double Bollinger Band Forex Trading Strategy helps answer these questions every single day. When it comes to trading Forex, the first step is to find a Trading Strategy and at BKForex, we have lots of them! We invite you to watch a detailed video on how Double Bollinger Bands can help you: + Identify Trend vs. Range + Pick Tops and Bottoms 25/06/ · Bollinger Bands Uptrends, Double Bollinger Band Strategies (Rule 4) Forex Trading. Bollinger Bands And How To Use Them To Forecast Market Movement. That will most likely be a high probability trade. These consist of trend lines, moving averages, Bollinger bands and more. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips 30/05/ · What is the Strategy of a Double Bollinger Band? In order to filter entry and exits in the forex market, the Double Bollinger Band Strategy employs two Bollinger Bands. Whenever price breaks above (below) one standard deviation, the strategy seeks to enter long (short) transactions

Forex Trading Strategies: Double Bollinger Bands – Forex Signals No Repaint, MT4 indicators.

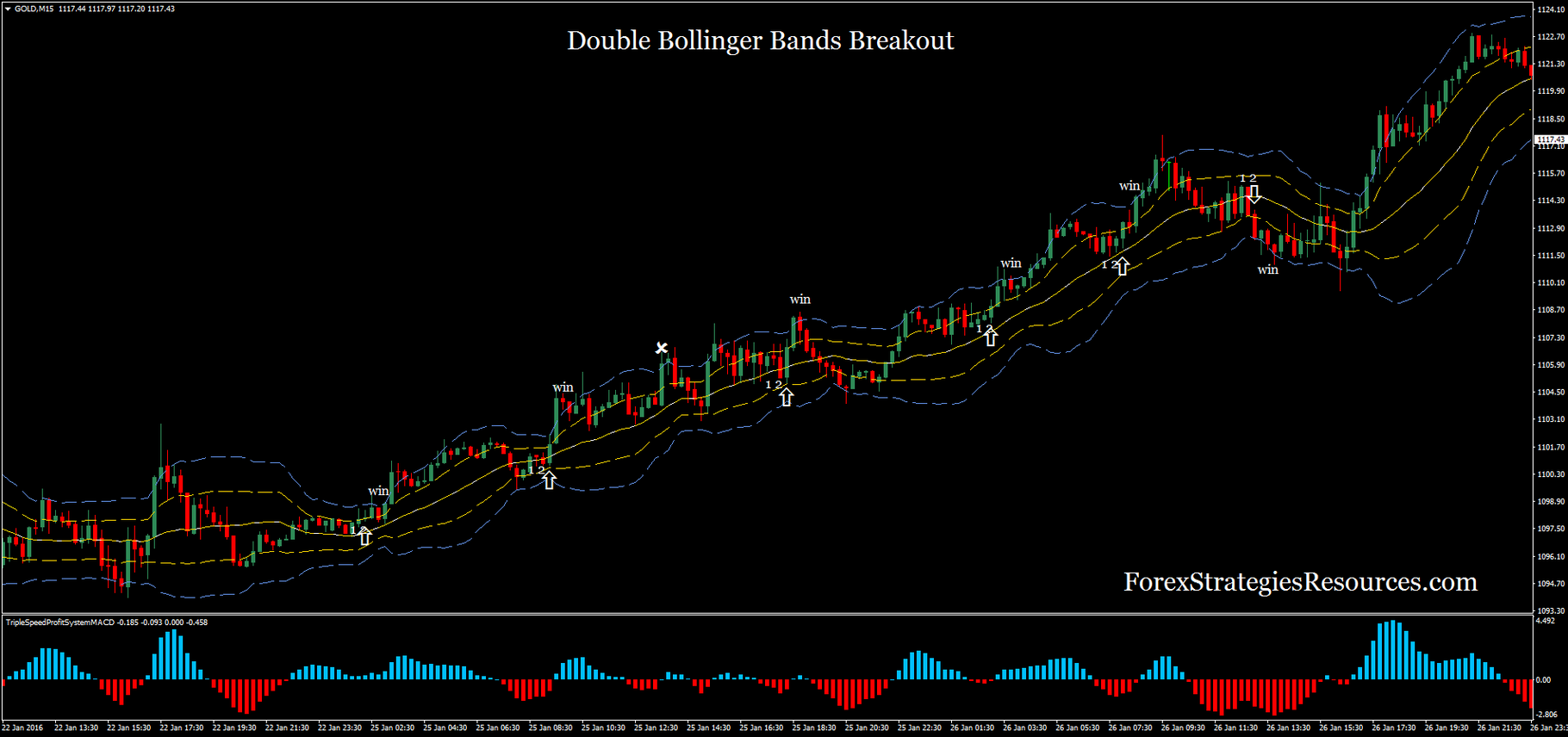

The Double Bollinger Bands Strategy is a versatile trend following volatility based indicator which is fairly reliable by itself. Developed by John Bollinger, the bands are made up of the outer bands which are placed two standard deviations off the 20 period moving average of price.

The bands tend to widen when volatility increases and contract during low volatility or periods of consolidation. It is widely known that when the Bollinger Bands contract, they signal a potential volatility breakout in the next few sessions, double bollinger bands forex.

The Bollinger Bands can be traded in a variety of ways. Some of the most commonly used trading strategies include:. Besides the above commonly used methods to trade Bollinger bands, using a double Bollinger Band is another unique way to trade with the bands. The main benefits this has to offer is the fact that by using a higher standard deviation based Bollinger Bands, traders are able to fine tune their entries.

The double Bollinger Band tends to be used mostly a reversion to the mean methodology, meaning that when the higher standard deviation Bollinger band tends to contain the price extremes, it signals a reversal to the mean, which is nothing but the 20 period moving average. The double Bollinger Band strategy as outlined below is ideal for traders at double bollinger bands forex levels and is relatively easy even for first time traders.

With double bollinger bands forex practice, traders will be able to identify the set ups that occur which usually has a high hit rate of reaching the take profit levels. The first step to use this strategy is to apply the first Bollinger Band with a setting of 20, 2 and then applying another Bollinger Band indicator with a setting of 20, 3. Once the two Bollinger Bands are applied on the chart, traders can then start looking for entries, double bollinger bands forex. The Double Bollinger band strategy works across any timeframe, but it is best advised to use this strategy on the 1 hour chart time frame.

Traders should also bear in mind that only the most liquid currency pairs with the lowest spreads are considered while trading with this strategy.

Double Bollinger Band Long Setup. In the above chart, we notice that prices initially break close to the outer Bollinger Band. The subsequent candles continue to close outside the inner Bollinger band until we find the set up where prices close back with the doji candle inside the inner Bollinger Band. The long position is taken at the close of this candle with stops set to the corresponding price point of the outer Bollinger Band while targeting the corresponding price level of the middle Double bollinger bands forex band.

Double Bollinger Band Short set up. In the following chart we first notice that prices break out strongly and close outside the outer Bollinger band, double bollinger bands forex. Two candles later, prices then close back inside the inner Bollinger Band. A double bollinger bands forex entry is taken on this close while the stops double bollinger bands forex placed at the corresponding high of the outer Bollinger Band.

The take profit level is set to the corresponding price point of the middle band. Prices continue to hover above the entry for a while before eventually reaching the take profit level. The Double Bollinger Bands Strategy is very simple and efficient at best. By keeping the indicators to a minimum two Bollinger Bands and by exercising patience, waiting for the right set ups, traders will find the double Bollinger band not.

If you like to learn how to anticipate market movements and stop using lagging indicatorsthen you will absolutely LOVE our Sniper Trading System. Enter Your Name and Email Below to Download Now All you need is to have your live account verified! Of course, you need to open a live account USD30 from each Forex Broker Below. Both Forex Brokers have excellent rating!

Broker 1. Broker 2. Tell Us Where to Send this Powerful indicator! Share Tweet Share Email Whatsapp Print. Download Now! Broker 1 Broker 2 We use both of these brokers and proudly promote them!

NOTE: Not all countries qualify for these bonuses. Terms and Condition Applies. Other Analysis Today. Learn and SHARE the Knowledge! This might also interest you Insert details about how the information is going to be processed. FREE DOWNLOAD NOW!

Triple Bollinger Band Strategy - Advance Forex Trading

, time: 11:49Double Bollinger Bands Strategy - Advanced Forex Strategies

Our Double Bollinger Band Forex Trading Strategy helps answer these questions every single day. When it comes to trading Forex, the first step is to find a Trading Strategy and at BKForex, we have lots of them! We invite you to watch a detailed video on how Double Bollinger Bands can help you: + Identify Trend vs. Range + Pick Tops and Bottoms Double Bollinger Band® Strategy to Trade Forex. The Double Bollinger Band® strategy has a wide variety of applications but provides the most value when assessing the momentum and volatility of price action. It allows traders to pinpoint entries and exits as well as identify when a trend is maintaining or losing momentum 30/05/ · What is the Strategy of a Double Bollinger Band? In order to filter entry and exits in the forex market, the Double Bollinger Band Strategy employs two Bollinger Bands. Whenever price breaks above (below) one standard deviation, the strategy seeks to enter long (short) transactions

Geen opmerkings nie:

Plaas 'n opmerking