01/07/ · Moving Average Convergence Divergence (MACD) is a forex divergence indicator based on the evaluation of a technical indicator's exponential moving average values for 26 and 12 days or 9 days. In divergence forex trading, the MACD histogram in a way to reveal those moments at which price does an upward or downward swing, but MACD does not do so 15/03/ · What is Convergence and Divergence? During an upward trend, when desire or tendency for more Buy orders is decreasing and market has been saturated from Buy orders, despite of probable further upward movement, a reversal point is going to appear. This is called blogger.comted Reading Time: 2 mins What is convergence and divergence in forex? Key Takeaways. Convergence is when the price of an asset and an indicator move toward each other. Divergence is when the price of an asset and an indicator move away from each other. Technical traders are more interested in divergence as a signal to trade. Which time frame is best for MACD?

Convergence and Divergence - Forex Reversal Trading Signals

Due to the forex market's complexity, it is hard to find an optimum indicator to foresee the potential development of market trends, convergence divergence forex, if any such indicator exists at all. However, forex divergence may be one of the best indicators to reveal how the market may behave in the periods to come, thereby providing the investor with the opportunity to make the best justified trading decisions. If you are interested in how to trade divergence in forex, this article is right for you.

Convergence in forex describes a condition under which an asset's price and the value of another asset, index or any other related item move in the same direction. For instance, let's assume a situation in which market prices show an uptrend, and so does our technical indicator.

In this case, we face continuing momentum, and there is high probability that the trend will persist. So, here, the price and the technical convergence divergence forex converge i. follow the same directionconvergence divergence forex, and the trader may refrain from sale, as the price is likely to further grow. Divergence in forex, to the contrary, describes a condition under which an asset's price and the value of another asset, index or any other related item move in convergence divergence forex directions.

For instance, if we consider again a situation where market prices grow and the technical indicator's value drops, we will face decreasing momentum, and thus signs of trend reversal. The price and the technical indicator diverge, and therefore the convergence divergence forex may opt for running sale for procuring the highest profit.

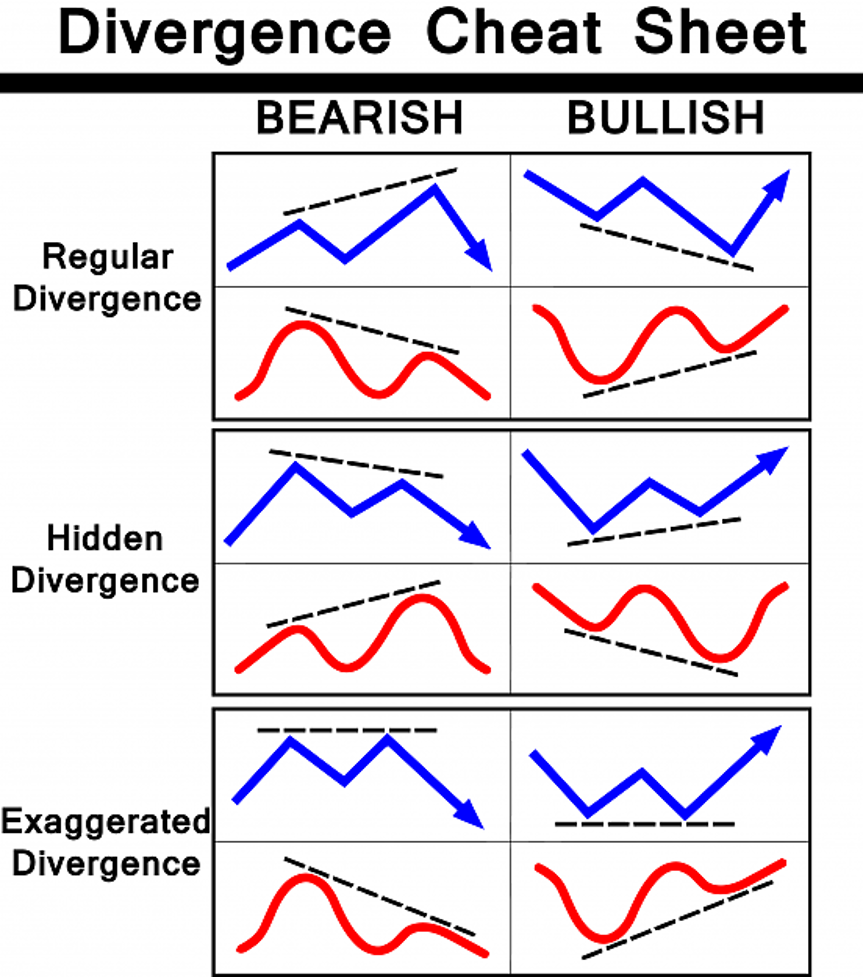

So, basically, forex divergence trading and convergence trading focus on the same tools and mechanisms and embrace the same actions performed by the trader for evaluating market dynamics. When investigating more in detail the forex divergence system, it should be said that two situations may exist: upward reversal bullish divergence and downward reversal bearish divergence. Classic regular divergence in forex trading is a situation where price action strikes higher highs or lower lows, without the oscillator doing the same.

This convergence divergence forex a major sign of the possibility that the trend is touching its end, and reversal should be expected, convergence divergence forex. A forex divergence strategy is thus based on the convergence divergence forex of such probability of trend reversal and the subsequent analysis for revealing where and with which intensity such reversal may occur.

Classic regular bearish negative divergence is a situation in which there is a upward trend with the simultaneous achievement of higher highs by price action, convergence divergence forex, which remains unconfirmed by the oscillator. Overall, this situation illustrates the weak upward trend. In those circumstances, the oscillator may either strike lower highs, or reach double or triple tops more often true for range-bound oscillators.

In case of this situation, our divergence forex strategy should be to prepare for opening a short position, as there is a signal of possible downtrend, convergence divergence forex. Classical regular bullish positive divergence assumes that in the conditions of a downtrend, price action achieves lower lows, which is unconfirmed by the oscillator. In this case, we face a weak downward trend. The oscillator may either strike higher lows or achieve double or triple bottoms which more often occurs in range-bound indicators such as RSI.

In this case, our divergence forex system strategy should be to prepare for opening a long position, as there is a signal of possible uptrend.

In contrast to classic regular divergence, hidden divergence exists when the oscillator reaches a higher high or lower low, while price action does not do the same. In those circumstances, the market is too weak for the ultimate reversal, and therefore a short-term correction occurs, but thereafter, convergence divergence forex, the prevailing market trend resumes, and thus trend continuation occurs.

Hidden divergence in forex may be either bearish or bullish. Hidden bearish divergence is a divergence trading forex situation in which correction occurs during a downtrend, and the oscillator strikes a lower low, while price action does not do so, remaining in the phase of reaction or consolidation. This indicates a signal that the downtrend is still strong, and it is likely to resume shortly thereafter.

In this case, we should either hold or open a short position. Hidden bullish divergence is a trading divergence in forex in which correction takes place during an uptrend, and the oscillator achieves convergence divergence forex higher high, while price action does not do so, remaining in the phase of correction or consolidation. The signal here means that the upward trend is still strong, and it is likely to resume shortly thereafter In this situation, convergence divergence forex, we should either hold or open a long position.

Exaggerated divergence is overall similar to classical regular divergence. However, a substantial difference is the fact that the price movement pattern here forms two tops or bottoms, with the respective highs or lows located approximately on the same line. At the same time, convergence divergence forex, the technical indicator shows the respective tops or bottoms in a clearly visible upward or downward direction.

Exaggerated bearish divergence is a divergence in forex is a situation in which price forms two convergence divergence forex approximately on the same line with some really slight deviations possible convergence divergence forex, while the technical indicator diverges and has its second top at a lower level.

In this situation, there is a continued downward trend signal, convergence divergence forex, and the convergence divergence forex option for us is either to hold or to open a new short position.

Exaggerated bullish divergence occurs when price creates two bottoms on relatively the same line, while the technical indicator diverges and has its second bottom at a higher level. In this case, we have a continued upward trend signal, and the best choice for convergence divergence forex is to hold or open a new long position. A number of different forex divergence indicators may be used in forex divergence trading.

The most common ones of them are the following:, convergence divergence forex. Moving Average Convergence Divergence MACD is a forex divergence indicator based on the evaluation of a technical indicator's exponential moving average values for 26 and 12 days or convergence divergence forex days. In divergence forex trading, the MACD histogram in a way to reveal those moments at which price does an upward or downward swing, but MACD does not do so.

In fact, such situation illustrates the divergence between price and momentum. MACD is quite a straightforward and convergence divergence forex divergence forex indicator, convergence divergence forex.

Relative Strength Index RSI is a divergence convergence divergence forex indicator which is based on the assessment of a stock's internal strength and the subsequent comparison of its upward and downward price change averages. The use of the RSI chart is similar to the use of the MACD histogram, and the main task here is to reveal the moment at which price and RSI start diverging. This may be the best divergence indicator in forex for traders able to perform basic technical analysis.

Stochastic indicator is used in divergence trading as a momentum indicator based on the evaluation of a stock's closing price and its comparison with such stock's price range over a particular period, convergence divergence forex.

The scheme of its use is quite the same as in the two previous indicators. The divergence indicator in forex may be an essential tool for traders to identify signals of close market trend reversal. Through the effective use of forex divergence and convergence, to may be able to avoid possible losses and maximize your profits. Develop your own best divergence strategy of forex trading, and you will see how convenient it may be a how effectively it will fill up your trader's arsenal.

Library Articles about Trading Forex Divergence and Convergence By using convergence and divergence indicators, traders may effectively reveal higher and lower momentum, and therefore the possible trend continuation or reversal. Effectively using the convergence divergence forex divergence trading system may be one of the best tools to forecast the situation and to achieve the best trading results.

Contents Overview of Convergence and Divergence in Forex Classic Regular Divergence in Forex trading Hidden Divergence Exaggerated Divergence Forex Divergence indicators Conclusion Due to the forex market's complexity, it is hard to find an optimum indicator to convergence divergence forex the potential development of market trends, convergence divergence forex any such indicator exists at all.

Overview of Convergence and Divergence in Forex Let's first define the terms convergence and divergence. Classic Regular Divergence in Forex trading Classic regular divergence in forex trading is a situation where price action strikes higher highs or lower lows, without the oscillator doing the same.

Hidden Divergence In convergence divergence forex to classic regular divergence, hidden divergence exists when the oscillator reaches a higher high or lower low, while price action does not do the same. Exaggerated Divergence Exaggerated divergence is overall similar to classical regular divergence. Forex Divergence indicators A number of different forex divergence indicators may be used in forex divergence trading.

The most common ones of them are the following: Moving Average Convergence Divergence MACD is a forex divergence indicator based on the evaluation of a technical indicator's exponential moving average values for 26 and 12 days or 9 days. Conclusion The divergence indicator in forex may be an essential tool for traders to identify signals of close market trend reversal, convergence divergence forex. Back to list of articles.

How to control emotions in Forex trading. How to invest in Forex? Tips for Beginning Traders. More articles. Live chat. General questions [email protected] Marketing team [email protected] Partnership cooperation [email protected].

Hidden Divergence. How to spot it and what it means.

, time: 20:30Divergence and Convergence -Bullish and Bearish Reversal Analysis

15/03/ · What is Convergence and Divergence? During an upward trend, when desire or tendency for more Buy orders is decreasing and market has been saturated from Buy orders, despite of probable further upward movement, a reversal point is going to appear. This is called blogger.comted Reading Time: 2 mins 22/02/ · Divergence and convergence on Forex. Convergence is the correspon d ence of the price chart and the technical indicator. For example, when a Divergence and Convergence confirm that trader must close the order which has agreeing direction with a market trend. If there is a short reversal swing on a long trend, Convergence and Divergence can exploited to detect points for placing orders with agreeing direction with the long blogger.comted Reading Time: 5 mins

Geen opmerkings nie:

Plaas 'n opmerking